when will i get my minnesota unemployment tax refund

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill.

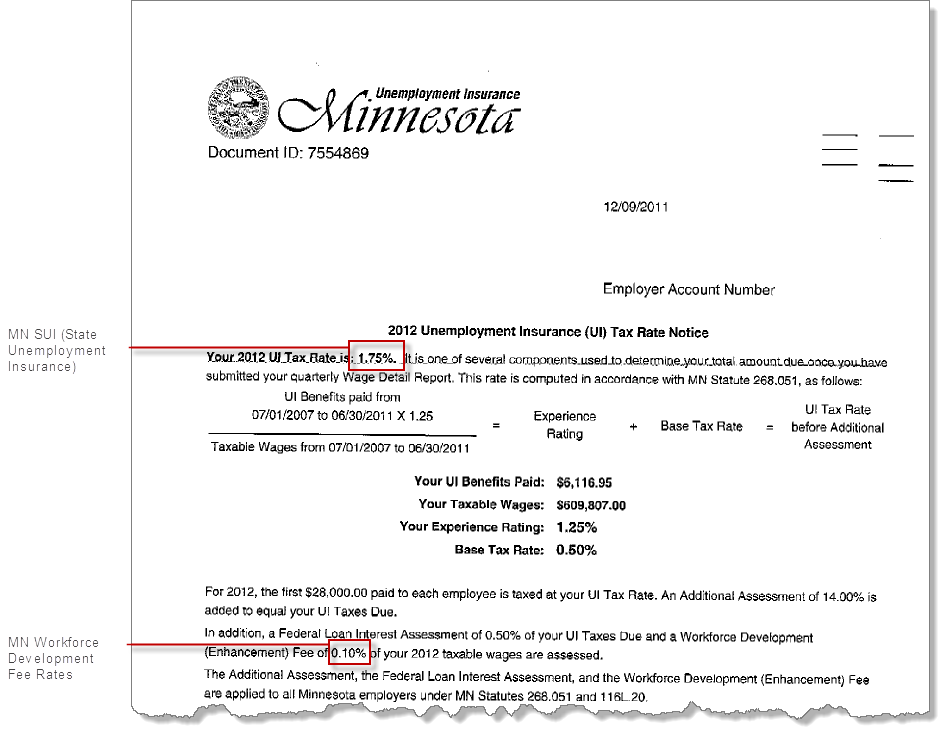

A New Look Is Coming To Your Minnesota Unemployment Insurance Account Employers Unemployment Insurance Minnesota

If you are still waiting for your refund after 21 days the IRS may be facing delays because.

. The 10200 is the amount of income exclusion for single filers not the amount of the refund. The new law reduces the amount of unemployment. Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in the.

When ready you will see the date your refund was sent. The child tax credit checks began. You made some mistakes on your tax.

The agency is juggling the tax return backlog delayed stimulus checks and child tax credit. - The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment. Refund for unemployment tax break.

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed. Only individuals with an adjusted gross income of less than 150000 are eligible for the tax break as well as those who received unemployment benefits during the pandemic. The system shows where in the process your refund is.

Every return we receive is different so processing time will vary. If you received unemployment benefits in Minnesota before 2021 you can also view your previous 1099-G forms. View step-by-step instructions for accessing your 1099-G by phone.

Minnesota state income tax Form M1 must be postmarked by April 18 2022 in order to avoid penalties and late fees. The average tax return time is 21 days. August 11 2022 - The Minnesota Department of.

It comes as Erin. The IRS says not to call the agency because it has limited live assistance. The IRS also said itll issue another refund batch before the end of the year but as of December 30 its yet to confirm when and how many it applies to you.

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Lee Daily

When Should Minnesotans Expect Tax Refunds Passed In The State Budget

Mn Dept Of Revenue Begins Processing Unemployment Insurance Compensation Ppp Loan Forgiveness Cbs Minnesota

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

667k Minnesotans To Get Pandemic Hero Pay Business Unemployment Tax Increase Reversed Twin Cities

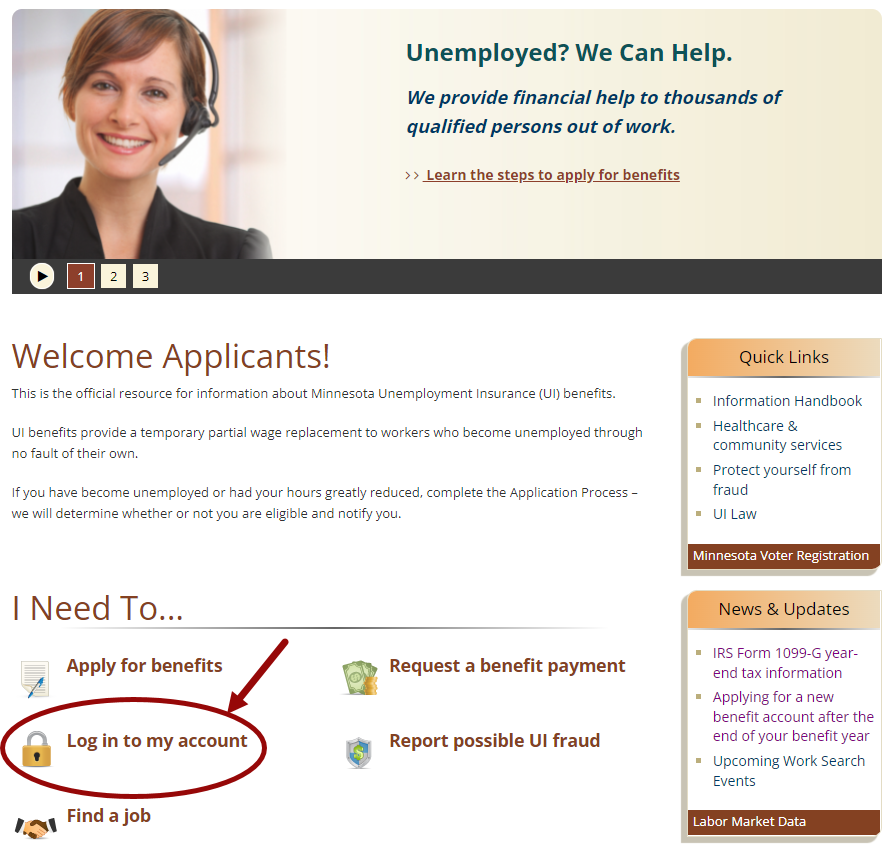

Index Applicants Unemployment Insurance Minnesota

Year End Tax Information Applicants Unemployment Insurance Minnesota

Your 2020 Tax Questions Answered Mpr News

Year End Tax Information Applicants Unemployment Insurance Minnesota

The Messy Fight Over Minnesota S Unemployment Insurance Trust Fund Explained Minnpost

Where S My Refund Minnesota Department Of Revenue

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

A New Look Is Coming To Your Minnesota Unemployment Insurance Account Applicants Unemployment Insurance Minnesota

Refunds On Taxed Unemployment Benefits Will Come Later Marketplace

Year End Tax Information Applicants Unemployment Insurance Minnesota